By Ellie-Rose Davies, Content Executive at IMRG

In 2023, UK ecommerce leaders struggled in the face of rising costs and reduced customer sentiment, where the industry declined by -3.2% Year-on-Year (YoY) according to IMRG’s Online Retail Index. Though they hoped for a more prosperous 2024, the results so far have shown a consistent downward trend for the total market.

To combat these declines, this blog uncovers some quick wins ecommerce leaders can implement to accelerate growth. Specifically, this blog focusses on four key areas:

- Opportunities to improve and expand

- Tactful promotions and tailored offers

- Post-purchase customer engagement

- Optimising returns for loyalty

First, let’s get into what’s happening across the industry.

A difficult start to 2024

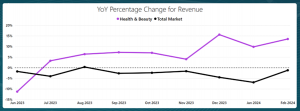

The total market reported YoY declines for each week of the year so far, most often between the -5% and -10% mark. January saw a decline of -6.9% YoY, representing one of the worst months in the history of ecommerce. February was slightly better at -1.2% YoY, with Valentine’s Day being a key helper here.

While the total market has been down, mostly driven by product categories such as Clothing, some retailers have better weathered the storm. Health & Beauty has been the top performing category for a while now and, as of February, is in its eighth consecutive month of positive-territory growth. In the first week of March, this category experienced an astonishing +23.8% YoY uptick, and that is against positive figures recorded in 2023!

The average conversion rate (Unique Visitors) for the total market in January and February had mixed performance. January performed slightly worse compared to 2023 (4.43 vs 5.13), but February performed slightly better (4.26 vs 4.18), leaving us curious for what the rest of the year has in store.

Traffic to online retail sites has been consistently down in 2024 so far, suggesting customers are not engaging with retail sites as much as we would have hoped. The rising trend of second-hand buying and selling may be a contributing factor here, among other things.

To find out more about weekly ecommerce performance, tune into IMRG’s Weekly Data Show which provides in-depth analysis of trends – every Thursday, on Zoom, at 2pm GBT!

Opportunities to improve and expand

It is essential for retailers to consider opportunities that will accelerate their performance in 2024, especially as IMRG predict 0% YoY growth for the total online market this year.

Burc Tanir, CEO at Prisync reflects on how 2024 is going by fast, and retailers are now trying to prioritise ‘quick but long-term wins.’ But how? Burc says that one of the most effective ways to keep on track is to ‘monitor customer feedback and stay abreast of market trends to ensure sustained success.’

‘In challenging times, simplicity often reigns supreme, and prioritising customer satisfaction can breathe new life into stagnating sectors,’ says Burc.

A way to do this consistently and efficiently is to reduce manual tasking. Burc recommends retailers to use automation for competitor analysis, tracking ‘competitor actions, stocks, and pricing to compete, using accurate data.’ In turn, they will be able to offer their customers fair prices and meet their needs.

Knowing that traffic to online retail sites is down, and that conversion is proving difficult, retailers can consider how to expand their offering.

Alexander Otto, Head of Corporate Relations at Tradebyte says, ‘With every second e-commerce pound now spent on marketplaces, expanding a retailer’s own .com offering into marketplace operations affords a huge opportunity to enter new territories, expand customer reach and increase revenue.’

He continues, ‘However, in the face of current socio-economic uncertainties, it’s crucial to choose the right market, leveraging real-time market data, building an understanding of customer behaviour, and conducting competitor analysis to stay ahead of the game and enhance competitive advantage.’

Alexander reveals how ‘Marketplace expansion worked well for UK fashion retailer Apricot, growing from their own e-commerce offering in 2021 to 10 different marketplaces in 2023. Diversification has helped Apricot adapt and thrive, achieving 566% GMV growth.’

Tactful promotions and tailored offers

Recent IMRG data has revealed that customers prioritise price when shopping online. Their second and third priority are product availability and discounts/offers. Thus, it is important for retailers to be tactful with their pricing and offers to generate desired results.

VP of Product Marketing at SheerID, Bill Schneider, says ‘Retailers can see fast and enduring growth if they create a compelling offer for a specific community that aligns with their brand.’

Bill exclaims, ‘Universal discounts can eventually condition customers to wait for the next promotion, but exclusive offers for groups like students, teachers, and healthcare workers inspire great loyalty. They make those communities feel valued by your brand, which motivates members to share them with others in the group.’

‘Companies, like Spotify, Lufthansa, and Fraser’s Group have seen impressive results with this approach. BackMarket’s exclusive student discount drove 5x back-to-school orders and a CLV that was 30% higher than its global average.’

Dan Bond, VP of Marketing at RevLifter also reflects on the value of tailored offers, stating that ‘Data analysis can truly boost conversion rates. For instance, Bodykind implemented offers at various spend thresholds, targeting those who abandoned carts, resulting in increased conversion and AOV. Try segmenting your audience and tailoring offers accordingly.’

Another example offered by Dan is US Polo Assn, who ‘tested two different types of promotional strategies, percentage versus dollar-off, and found no major difference. Yet, dollar-off promotions compromised less overall value.’

Dan’s final example is Shop4Runners, who ‘addressed potential drop-outs by implementing a discount when customers copied product names to search for better prices. Identifying pain points and creating targeted solutions to enhance conversion is always worth it.’

Post-purchase customer engagement

By engaging with customers after they have bought from them, retailers can increase their likelihood of repeat purchases.

Gavin Murphy, CMO at Scurri says ‘Post-purchase customer engagement is the key for ongoing interaction, growing loyalty, and securing repeat business. It is often when the shopper is most likely to interact with brand-led communications, providing a valuable and effective channel to up- or cross-sell to the consumer.’

He provides the example of the menswear brand Dobell, who reported a ‘57% click through rate (CTR) on after-sale emails, creating a seamless brand building and retargeting opportunity within the customer journey. Additionally, by taking control of post-purchase communications, they have also reduced ‘where is my order’ (WISMO) queries by more than a third to improve business efficiencies.’

As Angus Knights, Head of Product Success at parcelLab says, ‘In today’s competitive ecommerce landscape, focusing on the post-purchase experience is a powerful differentiator. Retailers can see immediate improvements by implementing strategies such as personalised follow-up communications, transparent order tracking, proactive issue resolution, and a hassle-free returns process.’

He continues, ‘We work with a range of retailers with a diverse customer demographic and it’s very clear that those retailers who prioritise these aspects tend to outperform their competitors, demonstrating that an exceptional post-purchase experience is essential for long-term success.’

Improving the returns process

Often, returns are seen as an entirely negative part of retail. However, there is good that can come from them. Ensuring that the returns process is seamless can protect brand loyalty and the retailers’ reputation.

Sean Sherwin Smith, Product Director Post-Purchase, nShift reflects on this; ‘When it comes to upselling, shoppers expect to be able to return products they buy online and are loyal to brands with a customer-friendly returns policy. It can be a real point of difference for retailers if they get it right and it marks an ideal opportunity to cut revenue loss and strengthen the relationship with the customer at the same time.’

He says, ‘One company that has used the retail effect to great impact is Hunkemöller, Europe’s fastest-growing lingerie specialist. They have offered their customers a seamless reverse ecommerce experience and have seen a spike in sales driven by a change in customer behaviour, shifting online to warehouse returns towards in-store with an increase of 15%.

Also, data from IMRG’s Consumer Home Delivery report 2023/4, supported by nShift, has shown that retailers can benefit from offering extended returns (more than the legal requirement of 14 days).

73.9% of 1000 survey respondents said that extended returns are likely to prompt them to purchase more items from the same website and 63.7% said extended returns would make them more likely to purchase an item when they initially intended to just browse.

When making a return, customers (69.9%) still prefer to use the returns label in their package over an online portal. However, over 80% would be happy to use a portal if it provided returns tracking or faster replacement/credit.

Want to read more? Here are some other IMRG blogs that cover a range of ecommerce topics:

Tax Changes To Be Aware Of In 2024 – IMRG

How UK Retailers Can Face The Challenges Of Increased Demand – IMRG

Using Interactive Marketing To Drive Customer Engagement – IMRG

Which One Is The Best? Ecommerce Pricing Strategies – IMRG

How to Protect Your Brand from Fake Traffic: Learnings from 2023 Holiday Data – IMRG

Published 19/03/2024