By Ellie-Rose Davies, Content Executive at IMRG

This blog looks at early Black Friday insights, helping you spot emerging trends and see how retailers are approaching the season.

Read on to find information on:

- Early IMRG insights

- Campaign launch timings

- Approaches to discounts

- Marketing experiences

- Post-purchase trends

Early IMRG insights:

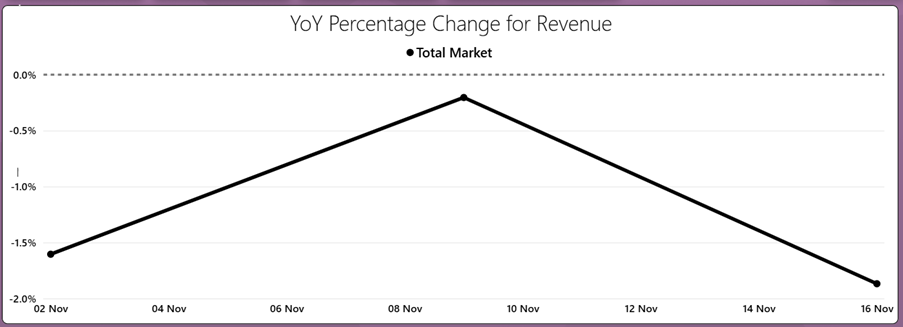

Source: IMRG’s Online Retail Index, 2025

November total market weekly data has been negative Year-on-Year (YoY), that is according to IMRG’s Online Retail Index that is representative of £30bn+ in online spend.

The first week was down -1.6% YoY, the second week was almost flat at -0.2% YoY, and the third week was down -1.9% YoY.

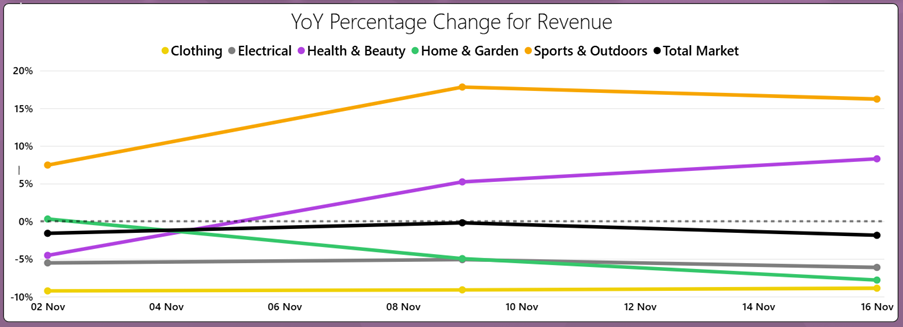

Source: IMRG’s Online Retail Index, 2025

While many Electricals’ retailers decided to launch early, performance throughout the month so far had been ultimately negative. In a worse position are Clothing retailers, who have had a difficult year all round.

More positively, Sports & Outdoors had a fantastic start to November, and we saw strong performances across Health & Beauty.

During our most recent webinar, we shared exclusive Black Friday week insights. We revealed that Monday 24th November was down -1.7% YoY. And as we’re feeling generous, here’s some exclusive data for the readers of this blog:

Tuesday was up +4.4% YoY which brought promise for the rest of the week.

Did the momentum continue? Or did it drop away? Keep an eye out for our upcoming events which will reveal all…

Campaign launch times:

Numerous retailers started their campaigns earlier this year, with some as early as the second week of October. We have seen the trend for starting campaigns earlier for many years now, where customers are growing used to a ‘Black November’ rather than a ‘Black Friday.’

Deann Evans, Managing Director, EMEA at Shopify also have noted how retailers are starting earlier; ‘Black Friday momentum is shifting earlier.’

‘Shopify research shows 29% of UK shoppers plan to start their holiday shopping earlier this year. Spending is also up, rebounding to £181 this year from £159 in 2024.’

Deann shares, ‘Our research shows a shift change among businesses too, with 76% expecting to start promotions before Black Friday week. For example, World of Books is offering promotions on its membership scheme, with extended deals on over seven million titles.’

‘AI integration is also critical. 27% of shoppers intend to use it to help them find deals, so merchants can get ready to make AI-powered commerce easy.’

Similarly, Andrew Scanlon, Head of Sales and Marketing at Staci notes the trend for early campaigning; ‘This peak season, brands are starting campaigns early to build anticipation and hype.’

‘They are teasing offers and sales weeks in advance to build excitement and capture early sales. Some are even using countdown timers on websites, socials and emails to create urgency.’

Andrew describes how ‘brands are building a community around their products – rewarding loyal customers and email subscribers with early access to deals or exclusive discounts. This sense of exclusivity encourages retention and repeat purchases.’

‘By displaying real-time stock information on product pages, brands are setting clear expectations and helping prevent disappointment when popular items sell out.’

Experts at Prisync raise an interesting point, ‘Due to the major uncertainty in the economy caused by tariffs, many consumers have been encouraged to spend more and earlier, as they think prices might increase later on.’

‘As pricing is one of the most important factors in purchasing, this uncertainty led retailers who have closely monitored their competitors and the stock information, and put together a solid pricing strategy throughout the holiday season to start their campaigns earlier as well.’

Prisync say, ‘For example, Amazon leads an early Black Friday week campaign that allows customers to take advantage of limited-time deals and early Black Friday discounts on several products.’

‘There are several tactics that work well, such as creating a sense of urgency, extending the promotion periods, offering free shipping, emphasising that this will be the only discount customers will receive, or extending the return period without lowering prices, especially for luxury brands.’

Approaches to discounts:

Our community of experts have noticed some interesting things around the patterns of discounting this year.

Hemang Nathwani, CEO and Co-Founder, at Price Trakker shares ‘Many retailers began discounting in late October, but shoppers are showing stronger interest in brands that keep discounts targeted and consistent, rather than constant flash deals.’

‘Many of the best-performing retailers are those that monitor competitor pricing daily and adjust only when necessary. This approach protects margin and keeps campaigns credible. Broad discounting is losing impact, while data-driven precision is proving more effective in maintaining both sales momentum and brand value.’

Similarly, Dan Bond, VP of Marketing at RevLifter reflects on how brands are ‘trying to preserve their margins.’

He says, many ‘Smart brands are moving away from blanket discounts toward targeted offers based on customer behaviour. We’re seeing more dynamic approaches – cart abandoners get different incentives than repeat customers.’

‘The retailers succeeding aren’t just discounting deeper; they’re being more strategic about who sees offers and when.’

Dan continues, ‘Innovation stems from testing various promotional mechanisms (such as free shipping thresholds, tiered discounts, and bundle offers) and measuring actual profitability, not just conversion rates. The winners protect margins while still driving volume.’

Alexander Otto, Head of Corporate Relations at Tradebyte notes generational responses to discounting. Firstly, he notes that ‘Black Friday 2025 marks a shift from hype to trust.’

‘YouGov reports that 35% of UK shoppers are now less interested in mega-sale events, signalling fatigue with blanket discounts.’

‘While Gen Z and Millennials remain active deal-seekers, they prioritise authentic value and transparency over the deepest cuts. Fashion, luxury and beauty continue to lead when offers feel credible.’

Alexander shares how ‘Social media drives discovery – 65% of Gen Z spot campaigns online – but trust drives conversion. Retailers like John Lewis, Boots and Argos are adapting with curated, clearly priced deals on premium brands and cross-channel consistency to keep confidence high in the post-sales hype era.’

Marketing experiences:

As early Black Friday activity picks up, two themes are standing out: brands are starting promotions sooner, and consumers are taking longer to commit. These shifts are shaping how marketers approach both affiliate and paid channels.

Bhavesh Patel, Head of Global Key Accounts at Awin reveals ‘Black Friday continues to start earlier each year, with brands like LOOKFANTASTIC, Currys and Shark already active.’

‘LOOKFANTASTIC is leading with onsite voucher codes, while others focus on value-led messaging such as “lowest price ever” and “price guarantee.”’

‘This strategy helps sustain engagement across weeks of changing offers. Early performance is mixed: overall affiliate sales on Awin are flat year-on-year since mid-October, though fashion and health & beauty sectors are up 8% and 10% respectively.’

Bhavesh exclaims, ‘Growth is being driven for many by loyalty platforms, technology partners, and early content creator engagement.’

For Black Friday itself there is an expectation that retailers will provide ‘more targeted, refined offers and fewer broad discount codes, potentially refreshing for consumers swamped with discount codes and ultimately improving their shopping experience.’

Building on this, wider performance trends show how consumer caution and rising media costs are influencing marketing choices.

Rachel Said, Head of Affiliates at Genie Goals shares, ‘After a soft October, where retail revenue was generally down, traffic started to build, although it may had not been showing as sales.’

Interestingly, ‘Data shows that consumer demand is “pent-up,” not gone, with 63% of shoppers sceptical of “mega sale” discounts. Many retailers overcome this with “Price Trust” messaging (e.g., price guarantees).’

Rachel noted that retailers could have expected ‘a conversion delay.’ She notes how ‘43% of sales attribute to pre-Black Friday clicks, so at this time retailers could hold their mid-funnel budget stable.’

‘In paid channels, with Paid Search CPCs up 12% YoY, focus budgets on high-intent brand searches.’

‘Beat Meta’s “Andromeda” algorithm by running true creative diversity (video, UGC, static). Finally, in affiliates, leverage influencers as a core traffic driver, and audit codes to prevent “unplanned doubling up” discounts for smarter spend management.’

Post-purchase trends:

There have been some key early Black Friday post-purchase insights shared by our community. Core trends were highlighted across collection services, AI and communication, as well as returns.

Chandni Chandarana, SME & Retailer Marketing Manager at PayPoint says, ‘As Black Friday starts earlier each year, parcel couriers are preparing sooner for high volumes moving through Collect+ stores.

‘Our stores planned by increasing staffing, improving signage, extending opening hours, and working closely with partners on forecasting and inventory.’

“Steps such as these help ensure a smooth end-to-end delivery experience and boost the chances of driving impulse purchases and encouraging customers to return throughout the festive season.’

Gavin Murphy CMO at Scurri similarly reflects on the value of offering excellent customer experiences after checkout.

He saw ‘retailers using AI and predictive tools to personalise offers and optimise fulfilment.’

‘According to Scurri’s 2025 research, 59% of Millennials and 53% of Gen Z shoppers already use AI-based tools to find the best deals and they expect speed, relevance and reliability from the brands they buy from.’

Gavin continues, ‘Retailers that launch early, communicate clearly and use data driven insights to manage stock and delivery can capture spend before peak day itself. The trick is being able to combine smart pricing with seamless post-purchase experiences.’

Though plenty of sales around Black Friday is exciting, the hype can fall short when customers begin to return items as they do not meet expectations. This is a core trend seen by Justin Thomas, VP Sales EMEA at Akeneo.

Justin echoes a point made by Alexander earlier in the blog by saying, ‘This year’s early Black Friday campaigns show that the deal focused shopper has matured, driven less by hype and more by trust.’

‘Our PX Pulse data reveals that 69% of consumers have returned deal-day purchases, largely due to poor product information and misleading imagery.’

‘The best retailers are prioritising clarity, specifically transparent product details, trustworthy visuals and honest reviews, which trends to outperform aggressive discounting.’

‘Consistent omnichannel messaging and detailed product storytelling are all about transparency and lead to reduced returns and greater loyalty,’ shares Justin.

To conclude

Early Black Friday insights point to a market with mixed category performance, earlier campaign launches, more targeted discounting, and a stronger focus on post-purchase experience.

Consumers are acting cautiously, and retailers are responding to this with carefully considered strategies across affiliates, paid channels, and pricing.

Overall, the data shows that retailers are starting sooner and are moving more strategically than in previous years. We are busy crunching the data for our Black Friday 2025 events. Hopefully see you there where we will reveal all!

Want to read more? Here are some other IMRG blogs:

UK shoppers hold out: Cyber Monday captures more BF-weekend purchases than Black Friday – IMRG

We analysed thousands of Black Friday campaigns. Here’s what nobody tells you… – IMRG

From guest to member: encouraging account sign-ups for increased loyalty – IMRG

How personalisation and loyalty are shaping the future of eCommerce – IMRG

Why poor product matching skews your price strategy – IMRG

Published 01/12/2025