By Ellie-Rose Davies, Content Executive at IMRG

H1 online retail performance

Total market data

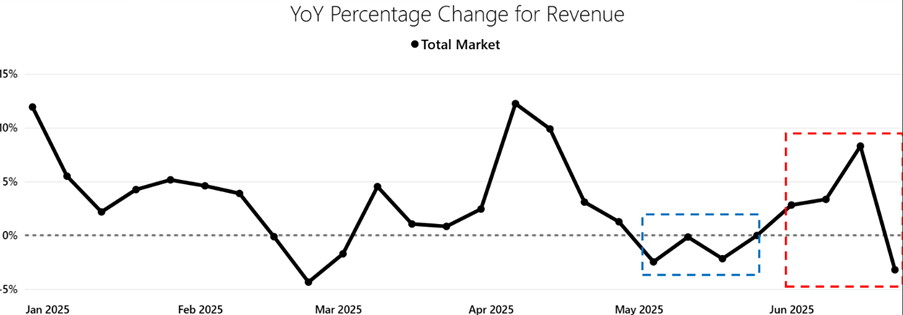

The total online market had some strong months in H1 2025, including January, February, April and June.

The market had a tough time during May (see blue dotted square below), with some weeks hovering around -2% Year-on-Year (YoY). However, June saw a positive uplift (see red dotted square below), with growth as strong as +8.4% YoY in w/c 15th.

Source: IMRG’s Online Retail Index data, Digital Dashboard

Out of the 27 weeks documented in our Online Retail Index for this year so far, 20 experienced growth.

Our survey of 77 retailers completed in July 2025 showed that most retailers (73%) experienced Year-on-Year growth for the first half of 2025. 22% experienced a YoY decline, but this was mainly between 0 and -10%, and very few experienced declines steeper than this.

YTD YoY product category data

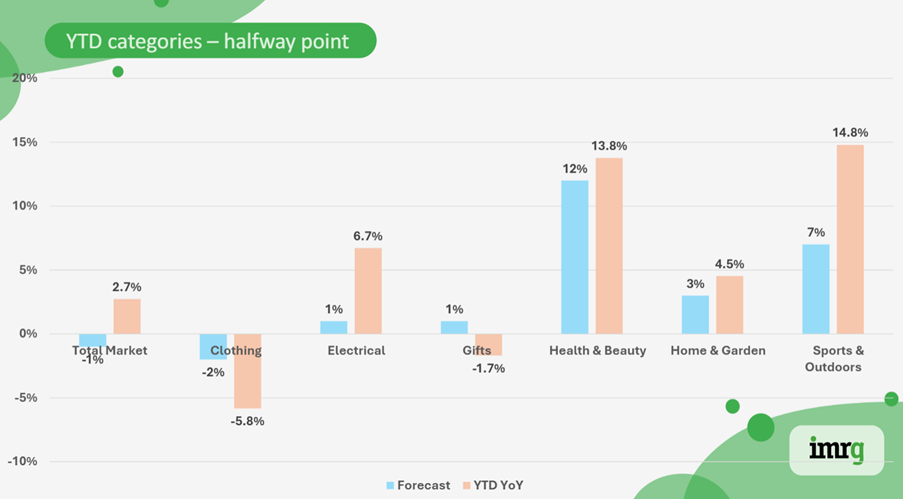

Source: IMRG Online Retail Index data

The Year-To-Date (YTD) YoY performance across online retail product categories for the halfway point of the year shows varying performance. The total market is doing better than forecasted, at +2.7% YTD YoY, compared to the -1% YTD YoY expected.

Clothing and Gifts retailers are performing worse than anticipated; Clothing is down -5.8% YTD YoY compared to our forecast of -2% for this category. Gift retailers are down -1.7% YTD, which differs from the +1% we expected.

The star performers at the halfway point of 2025 are Sports & Outdoors (+14.8% YTD YoY versus +7% expected), Health & Beauty (13.8% YTD YoY versus +12% expected), and Electrical (+6.7% YTD YoY versus +1% expected).

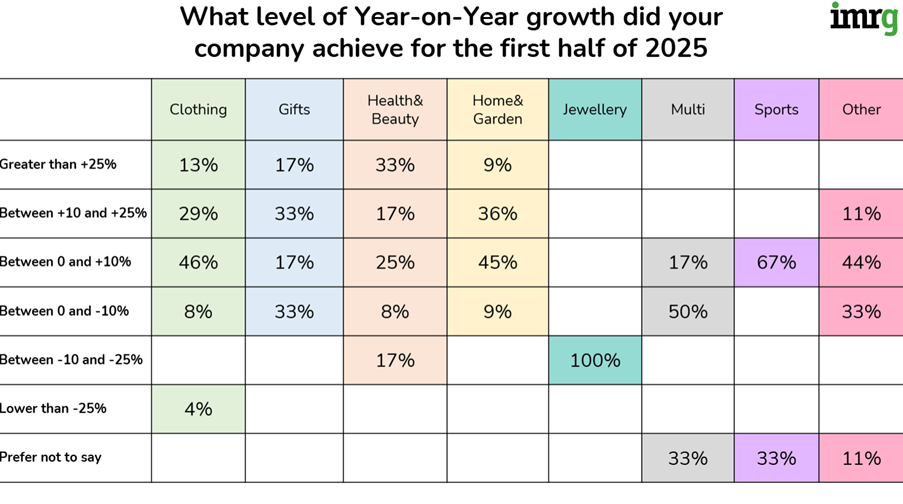

Product category performance split

We surveyed 77 retailers in July 2025 to gain a deeper understanding of H1 performance. The respondents to the survey included:

- 26 Clothing retailers

- 14 in Health & Beauty

- 12 in Home & Garden

- 6 in Multi department

- 6 in Gifts

- 3 in Sports & Outdoors

- 1 in Jewellery

- 9 in other categories

Most retailers who answered that they achieved Year-on-Year (YoY) revenue growth of ‘Greater than +25%’ belonged to the Health & Beauty product category (33%). 75% of all Health & Beauty retailers surveyed reported growth. This is in line with the trends we have seen in our Online Retail Index.

Interestingly, 50% of Multi department retailers reported that they experienced ‘Between 0 and -10%’ for the first half of 2025. Others (17%) saw growth but 33% preferred to not say this information.

Despite Clothing experiencing a YTD YoY decline, it is perhaps surprising to see so many report high levels of YoY growth. However, 41% of Clothing retailers believe they will have worse performance in H2.

Svea Svoboda, Team Leader at Awin, also shared some key product category trends with us that they’ve seen in H1. Svea exclaims, ‘H1 2025 saw a strong start, with January leading growth across retail, telco, and travel.’

‘A drier spring than 2024 drove uplifts in DIY, Beauty, and Clothing. Fewer long weekends smoothed the revenue curve, showing how weather and calendar shifts shape demand.’

Reflecting on these product category trends, Svea shares that ‘Looking ahead, brands can rework upper funnel strategies as AI search disrupts traditional traffic sources. At Awin, we’re seeing partners who adapt fast perform better (just as they did in H1 2024 after Google’s update).’

Awin have also seen ‘content affiliates maintain engagement with widgets, apps, and subscriptions.’

Now it’s time to hear from our community on their key findings from H1 and expectations for H2:

Increasing use of AI and smarter growth models

Throughout H1, retailers have continued to explore new ways of improving internal processes and responding more effectively to customer demand. One core way retailers are doing this is embracing AI as a core part of their strategy.

As explored by ParcelPerform, ‘We’re now in the era of AI Commerce, where AI agents from Google and ChatGPT execute hyper-rational purchases based on live data like price, stock, and proven delivery speed.’

They reflect on how AI can help execute a great ‘end-to-end delivery experience.’ They suggest retailers explore ‘a lean operating model powered by AI Decision Intelligence, using AI to automate analysis and turn operational data into a demonstrable advantage that wins the AI’s choice.’

Simon Dyer, Regional Vice President, UK & Nordics at Mirakl also reflects on how AI is part of what is helping retailers turn challenges into growth opportunities, he says ‘We’ve seen continued momentum toward the platform model, with marketplaces, retail media and AI reshaping how businesses grow and scale in this new eCommerce era.’

In H2, success may hinge on agility, collaboration across the ecosystem and tech-driven innovation. Many of the retailers who thrive will be those willing to rethink outdated models and embrace evolving customer expectations and rapidly changing market dynamics,’ shares Simon.

Utilising AI from checkout to post-purchase

AI’s influence doesn’t stop at the product page. Many retailers in H1 have made AI a core part of the checkout and post-purchase experience. This trend we can expect to grow in H2.

As shared by Gavin Murphy, Chief Marketing Officer at Scurri, some of ‘the most successful businesses this year have used AI not just to enhance personalisation at checkout, but to transform the entire customer journey, especially in the post-purchase phase.’

‘One major learning from H1 is that reactive operations are no longer sustainable. AI is now being used proactively to prepare for peak demand, predicting delivery bottlenecks, streamlining WISMO enquiries before they escalate and embedding timely, personalised messages into post-purchase communications.’

Gavin says ‘This shift has helped retailers reduce support overhead, protect brand reputation and increase repeat purchase.’

Aaron Stephens, VP Retail at PXP says “H1 2025 has been defined by retailers creating truly unified customer experiences. Recent PXP data shows 64% of merchants now view payment technology as a strategic growth driver, not just operational infrastructure.’

‘For H2, expect accelerated investment in payment orchestration platforms that unify online, in-store, and mobile experiences whilst providing the data intelligence needed for competitive differentiation.’

Aaron continues, ‘Additionally, we’re beginning to see early adoption of agentic commerce solutions, where AI-powered shopping assistants handle complex purchasing decisions autonomously on behalf of consumers.’

‘This trend will likely gain significant momentum in H2 as retailers experiment with AI agents that can negotiate prices, compare products across channels, and execute purchases based on individual customer preferences and budgets.’

Considering the post-purchase experience further are PayPoint who notes ‘With busier schedules, individuals are seeking convenient, safe and secure locations to manage their parcels.’

Collection services reflect ‘evolving needs of consumers, influenced in part by continued changes in working patterns and lifestyles. With busier schedules, individuals are seeking convenient, safe and secure locations to manage their parcels.’

‘Whether it’s dropping off a return after work or collecting a delivery at a time that suits them, these services are designed to fit seamlessly into the lives of customers.’

Product experience becomes a core conversion driver

Product content is no longer just about SEO, many retailers are using it to drive conversion and reduce returns.

Justin Thomas, VP Sales, EMEA North at Akeneo comments, ‘H1 2025 has confirmed an important truth that product experience is a primary battleground for eCommerce success. With tighter budgets and increasingly discerning shoppers, dynamic product data strategies can enrich, activate and optimise information across channels to boost conversions and reduce returns.’

‘A standout trend has been the use of customer reviews and behavioural insights to refine product content in real time. Forward-thinking retailers are using this feedback to adapt descriptions, surface the right attributes and present information in context to turn passive feedback into active optimisation.’

Justin expects that ‘As we move into H2, we will see more retailers leveraging AI within product information systems to drive personalisation, improve consistency across channels and react faster to changing demand. The challenge is aligning it with business goals and data foundations.’

Prioritising precision and personalisation

Personalisation continued to be a top strategy to offer superior customer experiences and drive sales in H1.

Head of EMEA Marketing at SheerID, Julienne Foutchou reflects on how personalisation is among the top priorities for shoppers in H2 2025. Her full list includes:

1) Customers expect brands to deliver seamless experiences whether they’re online or in store, so providing connected shopping experiences throughout the buyer journey is essential.

2) Tailoring personalised experiences to shoppers’ preferences – and rewarding people for who they are – are key for driving sales and building loyalty. 91% of consumers say they’re more likely to shop with brands that recognize, remember, and provide them with relevant offers and recommendations, according to Accenture.

3) Identity-based rewards, powered by permissioned data, can boost lifetime customer value without hurting a brand’s bottom line. Old tactics like blanket discounts tend to no longer work. Brands need to deliver precise, high impact offers that feel earned, not just expected.’

Dan Bond, VP of Marketing at RevLifter reinforces how for many retailers, blanket discounts do not work. He shares that in H1 ‘The winners focused on efficiency over expansion—better margins, smarter inventory management, and targeted customer acquisition.’

‘Macroeconomic uncertainty made consumers pickier, which ironically helped retailers who already understood their customers.’

‘The losers kept discounting everything, training customers to wait for deals. Key learning: uncertainty rewards precision. For H2, expect continued volatility. Retailers with strong fundamentals and better understanding of data will thrive,’ says Dan.

Alexander Otto, Head of Corporate Relations at Tradebyte, echoes the value of personalisation in retailers’ strategies, alongside the growing importance of precision:

‘In H1, successful retailers focused on steering; tracking the right KPIs and acting fast to optimise performance across channels. With acquisition costs rising, retention through personalisation and smarter assortment planning became crucial.’

‘ Returns and fulfillment costs stayed high, underscoring the need for operational precision. As we move into H2, sustainable growth will hinge on real-time data, agile inventory strategies, and expansion into new formats like social commerce.’

Alexander says ‘Trust and transparency remain essential, especially as privacy regulations tighten. Retailers that can connect insights with action across markets will stay ahead. Scaling in H2 means steering with intention, not reacting by default.’

Paid media evolves amid rising costs and shopper complexity

One key trend in H1 is that the cost to acquire customers via paid media has increased. What does this mean for retailers in H2?

Rachel Said, Head of Affiliates at Genie Goals shares, ‘H1 saw rising costs in paid social (+13% YoY) and PPC (10-20% YoY), with agility and smarter investment, especially in Meta and targeted PPC shopping strategies, being the key to surviving and preparing for H2.’

‘Diversification emerged as a central theme for many retailers, with affiliate marketing resurging and TikTok gaining traction, now making up 15-25% of paid social spend.’

Rachel tells retailers that ‘Expanding activity within core channels can be more essential than ever! Retailers are shifting PPC strategies from pure conversion to include brand awareness, leveraging messy shopping journeys and exploring Demand Gen to get in front of more customers as they research.’

‘As H2 approaches, early prep, including building paid social audiences, optimising PPC (self-managed CSS saves 20%), and reviving affiliate programs, can support peak success.’

Trading Conditions Tighten – Margins and Trust Under Pressure

As we step into the second half of the year, retailers are navigating increasingly turbulent trading conditions. From shifting global trade policies to inflation-driven consumer caution, the pressure on profitability is mounting.

Nikhita Hyett, General Manager EMEA, Signifyd says, ‘Trade friction re-emerged as a major theme in H1. New US tariffs on UK goods along with proposed changes to the de minimis threshold have added fresh complexity for UK retailers selling into the US. While the de minimis change hasn’t yet affected UK shipments, it signals a shift retailers should start preparing for.’

‘Our latest research found that 75% of retailers have increased prices and over half have passed those costs on to customers. But price hikes alone are not a long-term fix.’

Looking ahead to H2, retailers should consider their ‘fulfilment strategies, tightening fraud and abuse controls and delivering seamless, trustworthy experiences. In a competitive market, loyalty will be hard-won and easily lost,’ shares Nikhita.

Georgina Farrow, Interim Client Services Director at Summit, notes how they’ve seen ‘encouraging growth in traffic and CVR across our client base, while AOV continues to be the more challenging metric. This aligns with signs of increased consumer confidence, but also with consumers tightening their retail purse strings across particular categories – instead opting to travel.’

‘H1 has been eventful, with US tariff announcements and businesses dealing with additional costs following the 2024 October budget , and it doesn’t seem to be quietening down. As we head into H2, we anticipate intensified market competition driving up costs, alongside heightened scrutiny of market share and performance across the board.’

Experts at Prisync say that ‘price intelligence solutions are and will remain a hot topic to provide competitive prices as the eCommerce industry continues to expand, despite recent tariff implementations becoming an issue to hurdle, where consumers are seeking better deals more and more due to the rising inflation.’

Retailer Outlook: Solid Performance, but what does H2 bring?

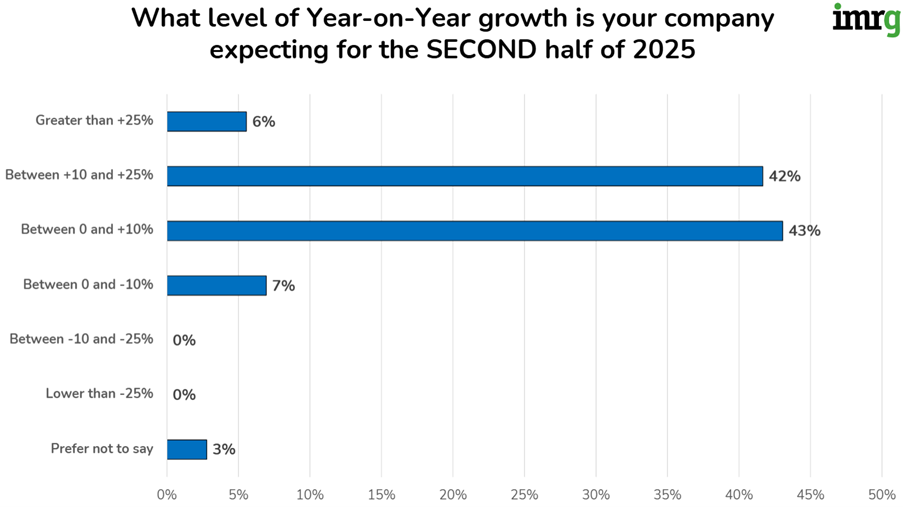

Most retailers we surveyed expect year-on-year growth in H2, mostly between 0 and +10% (43%) and +10% and +25% (42%). A few others expect growth of greater than 25%.

Promisingly, no retailers anticipate declines between -10 and -25%, and lower than -25%.

68% of retailers said their top priority for H2 is ‘Acquiring new customers,’ followed by 53% who said ‘Improve conversion rate.’ The changes and pivots retailers are making based on their performance in H1 is to ‘Update website UI/UX’ (62%) and 42% said ‘Explore new sales channels or marketplaces.’ Other popular answers were ‘Invest more in social media content’ (38%) and ‘Increasing ad spend’ (33%).

Overall, H1 performed better than expected. What do you expect for H2?…

Share your thoughts on our LinkedIn post:

Want to read more? Here are some other IMRG blogs that may take your interest:

- How to approach ID verification as eCommerce fraud increases – IMRG

- Beyond the bargain: unlocking full-funnel growth through affiliate – IMRG

- Top offers and rewards converting consumers in 2025 – IMRG

- Customer acquisition strategies that have proven to work – IMRG

- Ways to improve UX on eCommerce websites – IMRG

Published 29/07/25