By Nibble

“Black Friday! New deals just dropped! 1,000s of great savings now on!”

“Our biggest RRP savings!”

“It’s our biggest deal of the year!”

*all taken from major UK retailers’ websites this week

Two questions arise from all this grandstanding. Firstly, are they really the biggest deals of the year? And secondly, do they need to be as big as they are?

Which? announced this week that they had discovered Black Friday is not always as it seems – consumers in fact need to be wary of some retailers’ Black Friday hi-jinks, advertising ambiguity and even exaggerations.

Of course, Black Friday is its own worst enemy. Whether it is a symptom or a cause of the downward discounting spiral is almost irrelevant. But one thing that most retailers will agree with is, as one retailer answered in the IMRG’s pre-Black Friday survey that Matt Walsh revealed at Peak Connect in September, Black Friday is the “Worst, Invention. Ever!”

After all, there are two opposing forces at work: Black Friday performance dictates most retailers’ entire financial years. But consumers expect the best possible deals, creating lower and lower margins for retailers.

But are the prices that consumers expect (read: what retailers have trained them to expect) always the same as what they will accept?

Answer: no.

Nibble is an AI chatbot for ecommerce that negotiates prices between online retailers and customers. The final discount given in a Nibble deal is enough to “treat” the customer and make them feel special, but not as much as the retailer would typically sacrifice in a site-wide promotion. Both sides win.

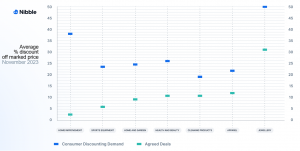

And after analysing the thousands of negotiations Nibble had during November, we’ve discovered that UK consumers expected to see an average of only 20% off marked prices.

This figure alone would disappoint many online retailers’ CFOs, as most have signed off on discounts twice as much as that. Even four times as much!

But here’s where the true desperation of the situation comes to light: the average Nibble deal in November gave away only 8.06% off marked prices, reinforcing that steep sitewide discounts aren’t always the answer.

How does 8% off compare to the discounts you have been giving away this month?

What we saw in some specially selected retail categories this month:

The key here is that retailers are basing their discounts off what they believe their customers want to see, the maximum they can afford to sacrifice, or what they fear their competition will do.

But they don’t base their discounts on what they believe they can convince a customer to happily accept if they engage with them and position their products and values in the right way. And so they over-sacrifice and perpetuate the Black Friday “love-to-hate-it” spiral.

Some specific sector observations:

- Jewellery retailers appear to have to fight the hardest to maintain margins in November. Their customers have been trained to expect the greatest deals, averaging out at half price.

- Home improvement however has a very interesting dynamic. Consumers seem to at first visit these sites expecting to see the same deals as in more discretionary areas of retail, such as health and beauty or jewellery. But retailers here have been able to show that Black Friday is “less of thing” because of home improvement’s less discretionary or gift-based nature. And so the final discount drops from 38% at the beginning of the conversation to only 3% when the deal is struck. A massive reversal.

Apparel’s Black Friday Black Story

But then there is the apparel category.

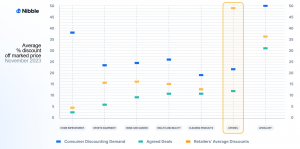

Look what happens when we take the same data as above, but add onto it the maximum discounts that retailers are willing to give away in Nibble negotiations…

In every other sector, there is a clear pattern of a customer expecting a high discount, higher than the retailer will tolerate, and then a negotiation ending at a lower price where the customer still feels indulged and the retailer has given away less than it would have originally.

But apparel has lost its way.

These retailers have lost sight of what the customer actually expects and are stuck in a desperate cycle of massive over-sacrifice. Why?

Unfortunately it’s self-inflicted. This category is perhaps the most fiercely competitive in all of retail, and most in this sector have responded to this competition by discounting deeper and deeper, not by emphasising their worth or quality. Ultimately, they compete on V-A-L-U-E, not V-A-L-U-E-S – and have therefore set their own terrible precedent that, they wrongly believe, they cannot escape.

Secondly, apparel is the sector most prone to the vagaries of fashion. As soon as a season or trend is over, the urgency and even scarcity that dictates their value instantly disappears. Suddenly, it becomes dead stock that the retailer simply cannot afford to continue to hold – and that needs to be sold at almost any price. Before they know it, apparel retailers are stuck in a world where deep discounting is traditional.

The main takeaway

Retailers – especially in apparel – believe that Black Friday margin loss is inescapable. But it is not.

Consumers’ discount expectations do not have to be pandered to. Their pricing expectations are higher than you think.

A good way to discover this is by opening up a dialogue with them. Offer a higher discount than the customer needs or expects, and they will take it – of course they will. But if you give them an opportunity to be heard, and give yourself a chance to set and defend your price point by reinforcing your values, you will be able to find the ideal win-win price point that makes everyone happy – and makes the customer come back for more, even outside sales season.

Published 24/11/2023