By ShoppingIQ

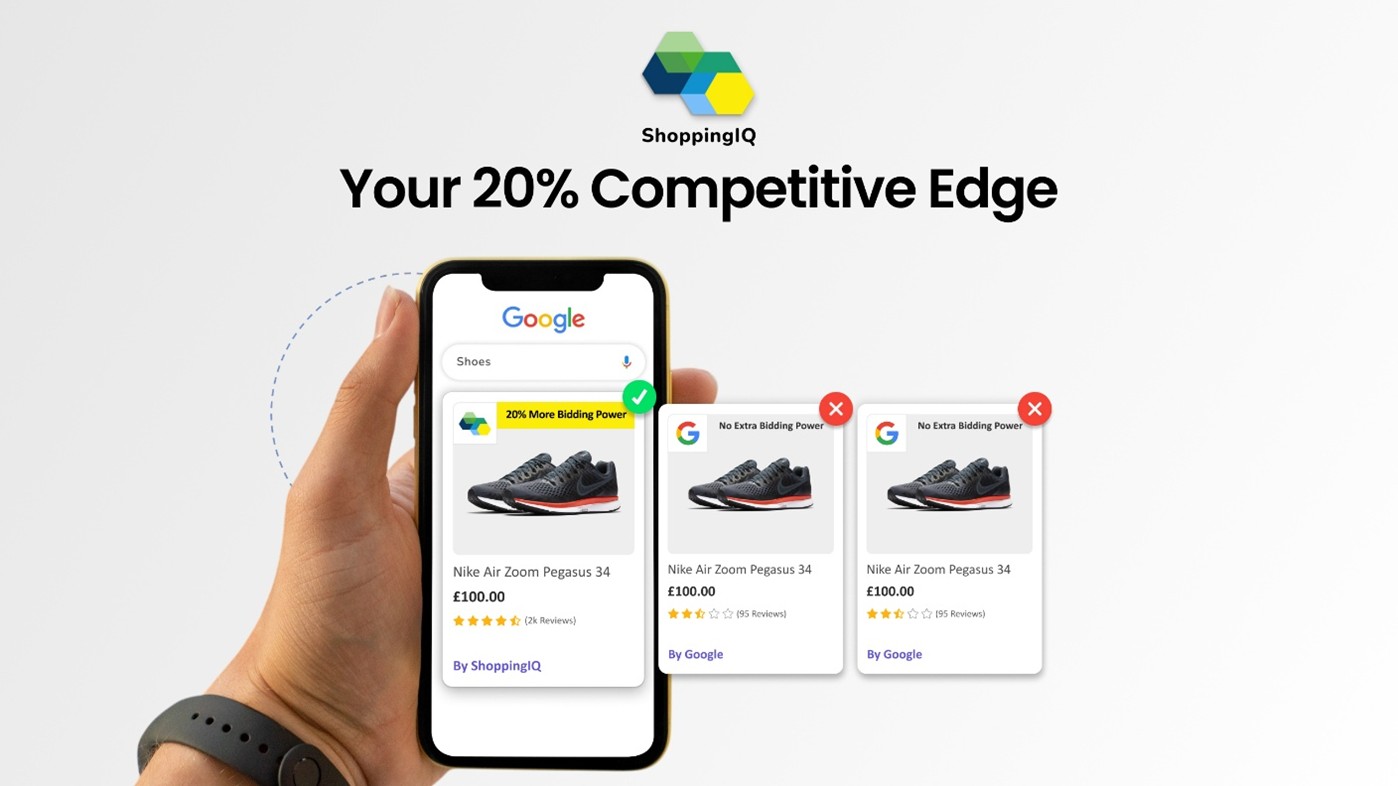

CSS Advantage: Unlocking 20% More Bidding Power In Google Shopping

In today’s performance-driven advertising landscape, retailers are constantly looking for smarter ways to stretch their media budgets without compromising results.

As CPCs rise and competition intensifies across key markets, the focus on efficiency has never been more urgent.

Google Shopping has become the backbone of paid media strategies for retailers. It drives high-intent traffic and fuels lower-funnel sales, but many brands are unknowingly leaving performance on the table.

Yet one of the most powerful and underutilised levers in the Google Shopping ecosystem remains largely overlooked: Comparison Shopping Services (CSS).

What Is The CSS Advantage And Why Should Retailers Care?

The CSS programme was introduced following a 2017 European Commission antitrust ruling, which fined Google €2.42 billion for giving its own Shopping service preferential treatment in search results.

Here’s the twist: Google had set up Google Shopping as a separate business unit (likely for tax and accounting purposes). But this structure backfired. Because Shopping was technically a separate business, the Commission ruled that Google was effectively giving one company inside its group a monopoly in the ad listings.

To comply, Google opened up shopping ad auctions to external players. This created a new ecosystem of certified Comparison Shopping Services (CSS), enabling partner companies to run Shopping campaigns on behalf of retailers.

Unlike ads run directly through Google Shopping, where an internal margin of around 20% is taken, CSS partners pass this value back to advertisers, giving them more bidding power. Importantly, this wasn’t part of Google’s strategy; it was the result of regulatory pressure.

A year after the ruling, the CSS programme was fully rolled out across Europe to level the playing field. It gave advertisers more choice, while also providing value back to CSS partners. This is done by passing the full 20% saving back to advertisers, giving them, by default, 20% more budget to win visibility in Google’s auctions.

Why Google Keeps It Quiet

This is something Google never wanted. While Google is legally required to offer these benefits, it is not obliged to promote this feature, let you know it exists, or provide any reporting.

If it did, the value of the benefit would be more widely known and would naturally encourage more advertisers to utilise a CSS.

However, offering permanent discounts doesn’t align with Google’s commercial interests. In short, using a CSS can help better manage the rising expenses of Google Shopping Ads. You can consider this your quiet advantage.

Google Makes It Hard To Realise The Benefits

As highlighted above, Google never wanted this programme. There is no report inside Google Ads that clearly shows performance with or without CSS. On top of that, some traditional CSS partners have misled clients by suggesting it’s a simple 20% discount on CPCs.

That’s not accurate. CSS provides 20% more bidding power, which can help reduce your CPC (cost per click), but more often it allows you to scale at a lower cost.

The benefit also only applies to Google Shopping placements, not Search, Gmail or other inventory bundled into the increasingly popular Performance Max campaigns, making efficiency even harder to track directly.

Alam Hosseinbor, Director at ShoppingIQ, highlights this point:

“Too many brands are being misled. This isn’t a flat 20% discount. It’s legally binding additional bidding power that gives your campaigns the edge.”

The Quiet Advantage: 20% More Auction Efficiency

Retailers who use CSS may see up to 20% greater reach or lower CPCs on the same spend. How? Because Google’s auction treats third-party CSS participants slightly differently, offering a structural advantage in bidding.

This doesn’t affect your visibility or placement; your ads appear in the same Shopping slots, but the cost to win those slots can be materially lower.

In practice, this means:

- The same budget goes further

- You can support broader product coverage

- You create budget headroom for testing, seasonal bursts, or new customer acquisition

What’s Really At Stake?

Google Shopping is a lower funnel, high-intent channel. Users searching for specific products are often near a purchase decision but acquiring that traffic is becoming increasingly expensive.

To stay competitive, retailers should:

- Maximise return on ad spend (ROAS) without capping scale

- Incorporate live signals from margin, inventory, and demand data

- Reduce wasted spend across product lines and audience segments

This becomes particularly challenging in environments like Performance Max, where campaign visibility is limited and automation demands smarter inputs.

Strategic Recommendations

If you’re a retailer operating in the EEA or Switzerland and not yet using a CSS partner, here’s where to start:

- Audit Your Shopping Campaigns: Review historical CPCs, conversion rates, and ROAS across top SKUs.

- Evaluate CSS Readiness: Ensure your data feed is compatible with CSS and assess your operational capacity to switch or test.

- Reinvest Savings Strategically: Use the media cost savings to fund:

- Performance Max testing

- Feed enrichment or segmentation

- Granular campaign structures based on lifecycle or profitability

Countries Eligible

CSS is available in all EEA countries and Switzerland. This includes major retail hubs such as: United Kingdom, Germany, France, Netherlands, Spain, Italy, Ireland, Poland and all other EEA member states.

ShoppingIQ partners with brands to activate CSS access as part of a broader commerce intelligence strategy, integrating real-time signals to optimise spend, surface new opportunities, and deliver measurable gains in campaign efficiency.

Published 03/10/2025