By Brad Houldsworth, Head of Product at Remarkable Commerce

Average-order-value (AOV) is a key metric that every retailer will regularly track and attempt to continuously improve upon. There are several secret tactics and levers available to retailers wanting to grow AOV – however, these strategies often have a positive and negative impact on other metrics, such as items-per-order and total revenue.

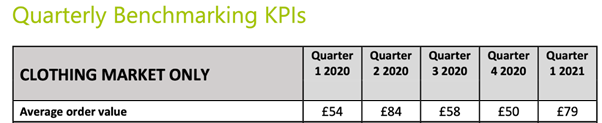

IMRG reported in their Capgemini Quarterly Benchmark report that the UK Clothing market has seen average-order-value (AOV) grow to £79 in Q1 2021, compared to £54 in Q1 2020 – which is 46% growth within 12 months. This trend illustrates that UK consumers are willing to spend more per order, but does that mean they are ordering less frequently?

This article lists 7 key tactics which retailers can utilise and test, sets out how to track the performance of these strategies, and points to the technologies is required to deliver them.

Strategy 1: Up-sell

Up-selling is the simplest tactic on the list. It is very common yet often not set up correctly. Typically, an up-sell product carousel can be found on the basket page or throughout the checkout flow (just like those items beside the till in the shop) – but the choice of items is crucially important. They should always be at least 80% cheaper than those in the customer’s basket. Ideally, the items should be related too – so the customer can see relevance and a natural fit with the products they are already committed to purchasing.

Strategy 2: Cross-sell

Cross-selling is a slightly harder tactic to implement, simply due to the relevance consumers now expect to see. Cross-sell product placements and carousels are recommendations based on the product being viewed, and therefore are commonly found on the product detail page (PDP).

The typical logic for this recommendation carousel is to surface products from the closest matching product category to those being viewed (e.g. the ‘black tops’ category, or the ‘single beds’ category).

Strategy 3: Bundling

Automation is important when it comes to scaling product bundling – in fact manually setting up bundles should be avoided at all costs, especially if you have more than 3,000 SKUs. It is pretty rare for an eCommerce platform to offer this functionality so a 3rd party solution is typically required (such as RichRelevance, Nosto or Segmentify). However, if your platform has a microservice architecture and can be customised, this should be easily achievable.

Strategy 4: Payment credit options

Consumers are willing to spend more money if there is less to pay up front, and flexible payment plans are proven to lower purchase barriers. Quite simply, customers presented with these options will see the purchase as a lower-risk and quicker solution than saving for the full amount. There are a few issues to watch out for and monitor, including ‘size bracketing’ (the purchase of many sizes of the same product) which leads to a high return rate, but also the risk associated with allowing customers to build up too much credit.

Strategy 5: Free delivery threshold

58% of UK households now have Amazon Prime, which includes free next-(or same)-day delivery. As a result, paying for delivery is becoming a harder pill for consumers to swallow – especially when costs are hidden and rather than clearly communicated throughout the customer journey.

Not every business has Amazon’s reach or financial muscle of course, but there are options for all retailers here. For instance, one well-performing and well-practiced strategy is offering free delivery if a certain basket threshold is reached. There is a sweet spot to be found here, so I recommend that retailers experiment with different thresholds every eight weeks, tweaking it in £5 increments until conversion rate begins to suffer.

Strategy 6: Introduce time-sensitive discounts

Consumers react and engage with campaigns when there is an imminent cut-off point, and this behaviour can be encouraged using ‘urgency messaging, such as count-down timers on discounts and promotions. Surfacing the countdown timer across all page types can help encourage customers to purchase whilst the discount is available. Similarly, any retailers are beginning to introduce tiered time-based discounting, where 50% is available for the 1st hour, then 40%, then 30%, and so on.

At Remarkable, our platform is endlessly customisable and tailored for each client – which means a retailer can design a unique function like animated discount tiers and have it easily developed and deployed within days.

Strategy 7: Incentivise with £ off, not % off.

Many consumers see monetary value discounts as better value and engage with them better, in comparison to percentage discounts. That’s because sale promotions need clarity and immediacy to be effective, with potential savings made as clear as possible – and unfortunately percentages are more difficult for consumers to comprehend and calculate themselves.

For example: when a consumer is offered a 15%-off code or a £50-off code on their £350 order, the £50 off discount is typically used more, even though the consumer can save an extra £2.50 by using the 15% off.

As well as these 7 strategies, there are many more opportunities and tactics which clothing retailers can use to improve AOV, like introducing loyalty schemes and bundling gifts with higher-priced items. However, each retailer is different so there is no single answer. The truth is every retailer should continually experiment with different trading techniques – even when existing techniques and strategies are working well, there are always gains to be made from further innovation and optimisation.

For instance, generally speaking, personalisation technology will always have a positive impact on all revenue metrics, including AOV. Your ecommerce platform should offer basic personalisation tools, to enable you to tailor your customers’ experiences. If it doesn’t, then it’s time to begin considering a re-platform.