By Benny Tadele, VP Global eCommerce, ACI Worldwide

The drive to digital

The digitalization of commerce has been a clear trend in recent years – but in 2020 we saw a sharp acceleration in the provision and adoption of digital channels and payment methods, and in new business models designed to take advantage of digital commerce opportunities. As consumers adjust their behaviour and their expectations in this increasingly fast-paced digital world, merchants must respond to stay competitive and profitable.

For merchants, this means retaining the flexibility to adapt and innovate while delivering, day by day, a safe, reliable and frictionless online or mobile shopping experience that supports their customers’ evolving payment preferences, promoting acceptance without increasing the cost to serve.

This is a tough challenge for any merchant. It is also a challenge that is best met by ensuring you keep control of your critical business relationships and are not controlled – and limited – by them.

The growing move to multi-acquiring

A global survey commissioned late last year by ACI Worldwide, and conducted by Edgar, Dunn & Company, has found that merchants are increasingly choosing to work with multiple acquirers, in an effort to address some of these challenges.

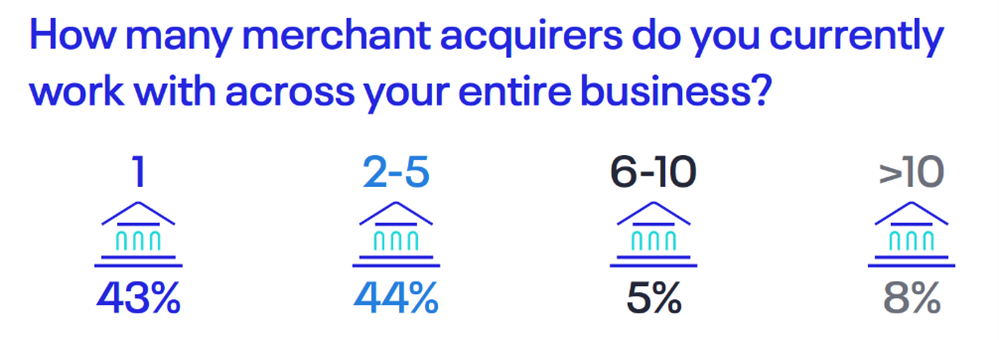

The survey shows that 57% of merchants now have a multiple acquiring arrangement – and 13% are working with more than 5 acquirers:

In addition, 40% of merchants with a single acquirer today are looking to engage with multiple acquirers within the next 12 months.

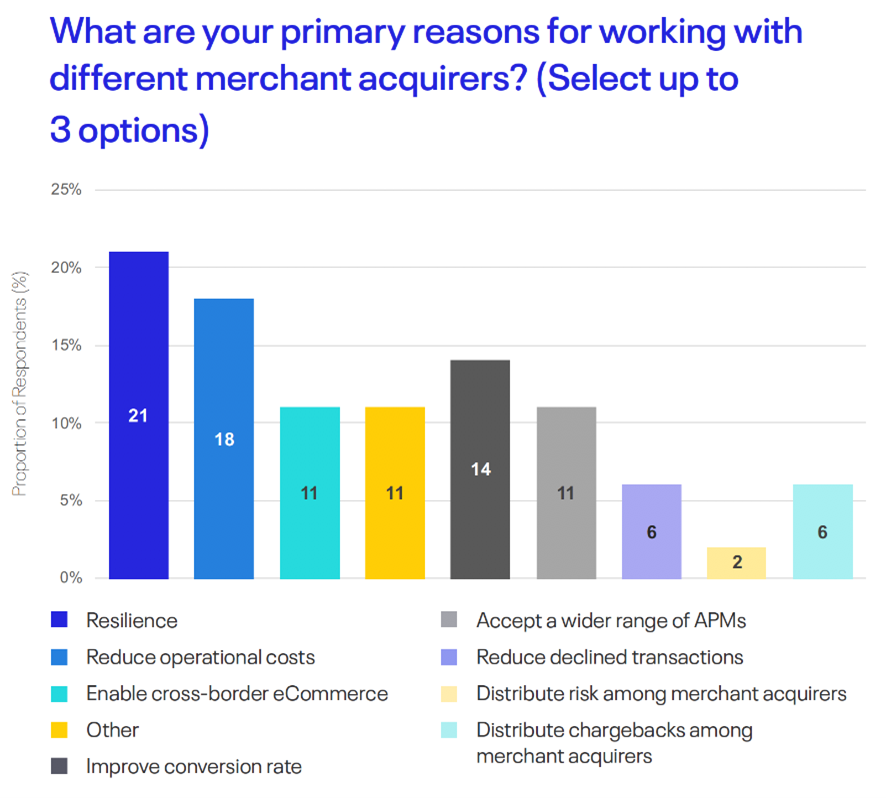

Three strong reasons for adopting a multi-acquiring strategy stand out in the survey:

Resilience and the freedom to flex

In a fiercely competitive industry, merchants need to ensure they can accept payments quickly and consistently – or customers will quickly abandon their online shopping baskets and go elsewhere. Business continuity is critical and single points of failure no longer an option. Where an acquirer suffers a loss of service, albeit temporary, the merchant must be able to switch traffic quickly to an alternative acquirer – and the option to re-route transactions declined by one acquirer to another or, for example, to route high risk transactions to acquirers most likely to accept them, also gives the merchant an important extra degree of flexibility in meeting customer demand.

Keeping control of costs

Having all your eggs in one basket almost always means more expensive eggs. Working with multiple acquirers gives a merchant a better chance of negotiating fees and combining local and global acquirers in different markets, for an optimal solution. In addition, the ability to route transactions to the most suitable acquirer also helps to reduce declines, and associated costs.

Increasing conversion with a wider choice of payment methods

Consumers today expect payments choice and to be able to pay with the method that best suits them, regardless of whether they are buying from a domestic merchant or one located overseas. Real-time payments, subscriptions and “buy now, pay later” (BNPL) options are gaining popularity, particularly for shoppers who need to closely manage their finances. More and more merchants are recognizing the need to access a wider choice of payment methods to cater for customers across different age and socio-economic groups and, critically, to support international expansion.

It is interesting to see that, among the merchants in our survey who have adopted a multi-acquiring strategy, 85% have seen an increase in conversion rates. Twenty three percent have increased their conversion rate by more than 10%. The ability to offer alternative payment options and to dynamically route transactions to the most suitable acquirer are both critical to achieving higher conversion and, in both cases, are important benefits of a multi-acquiring strategy.

As digitalization continues to gather momentum and forecasts of eCommerce growth increase, merchants need the right strategies, technology, vendor and partner relationships to ensure that they can create a compelling online or mobile customer experience. They also need the flexibility and control to ensure that they can adapt the strategy and switch relationships over time, so that their offer remains relevant and appropriate as consumer demands change, and as payments ultimately becomes a virtually invisible part of the customer journey.

Our full multi-acquiring research report, containing detailed data and insights, is available now: Multi-Acquiring and the Benefits for Merchants.

By Benny Tadele, Head of Product Line, ACI Worldwide

Published 18/03/2021