By Ellie-Rose Davies, Content Executive at IMRG

And breathe…Black Friday 2025 is officially over, and we have lots of data and insight to help you reflect on performance.

Inside this blog you will find:

- 8-Day Black Friday week YoY revenue trends

- Campaign start time insights

- Key stats and AI usage

- Channel-level performance trends across BFCM

- Approaches to promotions and profitability

- Post-purchase trends: Customer behaviour, delivery timeframes, cross-border trends, and returns

8-Day Black Friday week YoY revenue trends

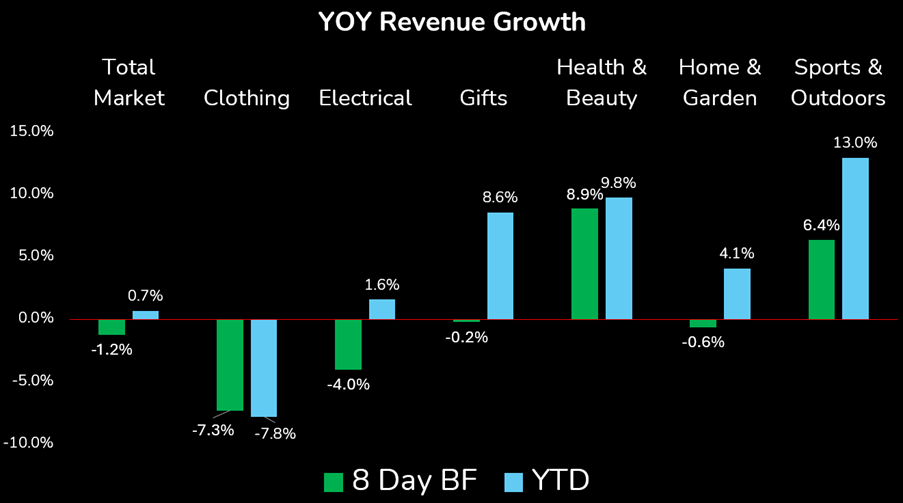

Source: IMRG’s Online Retail Index, Black Friday Tracker 2025

Across the 8-day Black Friday week (Mon 24th Nov-Mon 1st Dec), total market revenue was down -1.2% Year-on-Year (see the first green bar on the chart above) according to IMRG data. Black Friday itself was up +1.3% YoY, but the standout performer was Tuesday which was up +4.4% YoY.

Interestingly, Cyber Monday was down -3.2% YoY; last year Cyber Monday was flat and in 2023 it performed exceptionally well (+5.6% YoY).

Unsurprisingly to us, given that we have reported growth almost consistently for this category this year, Health & Beauty was the top performer during the 8-day Black Friday week. These retailers were up +8.9% YoY, and experienced an uptick of +12% YoY on Black Friday itself.

Sports & Outdoors also saw strong performance, at +6.4% YoY. This online product category has also seen the highest YTD performance, at +13%.

Negative news for clothing retailers who saw a decline of -7.3% YoY during Black Friday week, and -5.2% YoY on Black Friday itself. Of the largest 10 clothing retailers in our panel, 7 of them experienced declines on Black Friday.

Electrical retailers saw a decline of -4 YoY during Black Friday. Remarkably, 62% of

Campaign start time insights

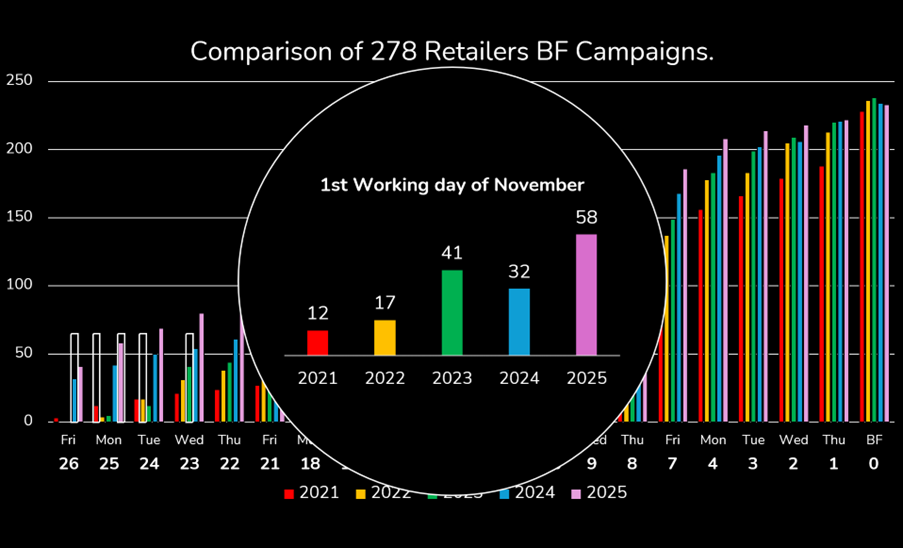

Source: IMRG’s Black Friday Tracker 2025

From our panel of 278 retailers, we have noted that each year more and more retailers have a live Black Friday campaign running on the 1st working day of November. From 12 retailers in 2021, to 41 in 2023, and 58 and 2025.

60% of retailers launched their campaign earlier this year compared to 2024, only 4% kept their campaign the same, and 36% went later.

What is interesting is that while retailers started earlier, most also ran their campaigns for longer (50%).

Key stats and AI usage

Our community of experts have also shared key stats from the period to help you understand performance. They also noted how AI has played a growing role over the Peak trading period.

Phelim Killough, Senior Data Analyst at Signifyd shares how ‘shoppers this year concentrated spend on fewer purchases. Signifyd research reveals how ‘Average Order Value rose 12%, offset by an 8% drop in the number of transactions and a 3.5% decline in basket size, indicating a more deliberate, considerate buying trend.’

‘Category performance reinforced this selectivity, as Leisure & Outdoor (+36%), Beauty (+19%) shone, while Fashion and Grocery slipped 9%.’

Phelim reflects on AI during Peak, sharing that ‘Our data also showed how the methods of product discovery and conversion are continuing to shift, with near-900% rise in AI-search conversions suggests shoppers are increasingly relying on assisted discovery to narrow choices quickly, aligning with broader patterns of more deliberate spend.’

Habib Ansari, UK Country Head at Worldline also reflects on key statistics and trends around AI:

‘From what we’re seeing across our merchant base, Black Friday 2025 continued to centre on the main discount days, even though promotions started earlier and ran for longer.’

‘Compared with a regular Friday, Wordline data shows transaction volumes increased by 32.26% on Black Friday and by 38.91% on Cyber Monday, showing that many shoppers still wait for the strongest offers before buying,’ says Habib.

‘Cards remained the most common payment method, accounting for around 63.5% of transactions, though alternative payment methods continued to grow, particularly digital wallets.’

Habib notes how ‘AI has been used in fraud prevention, risk management, and transaction decisioning.’

Many brands combined AI with ‘familiar, trusted customer journeys, keeping the focus on the buying experience rather than the technology itself.’

Channel-level performance trends across BFCM

Looking beyond overall performance, insights highlight how channel mix, timing, and cost efficiency evolved during BFCM.

Sam Thompsett, Head of Paid Social at Genie Goals shares, ‘Genie Goals clients grew across BFCM vs 2024, with Saturday as the standout revenue day (+25%).’

‘PPC peaked on Black Friday despite the pressure to go early. Fake Friday was overshadowed by late-October discounts, which yielded 30% lower CPCs – a key 2026 opportunity.’

Sam reveals ‘November PPC costs rose 7%, but paid social costs fell. Platform diversification dispersed Meta budgets, reducing competition, dropping CPMs & CPCs by 13%, with 3 platforms brands benefitting the most.’

‘Affiliate performance varied: incentive partners lagged, but CSS (+1000%) and content (+25%) thrived – a strategic shift from conversion to consideration.’

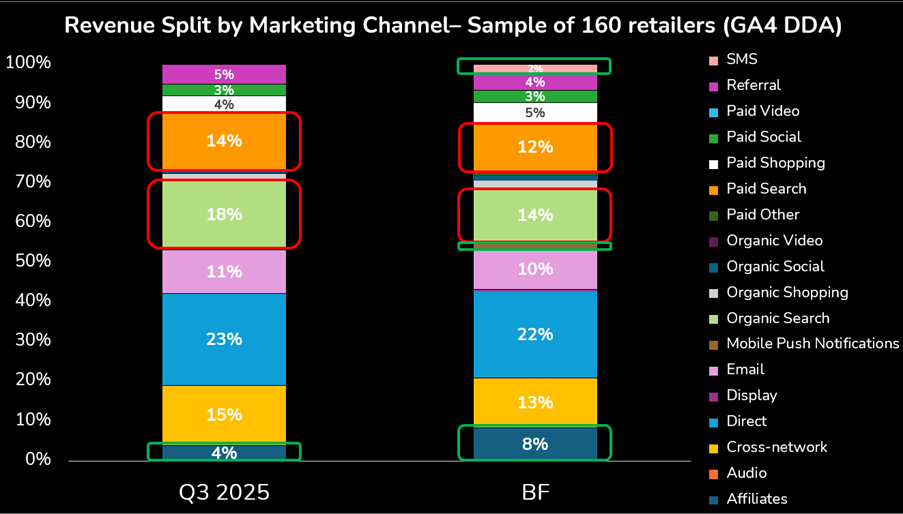

Source: IMRG’s Black Friday Tracker 2025

IMRG GA4 DDA data from a sample of 160 retailers showed that affiliate performance improved across Black Friday, jumping from 4% in a typical quarter (Q3) to 8% on Black Friday.

SMS also saw improvements, accounting for little to no revenue during Q3, but then jumping to 2% on Black Friday. Mobile push notifications also jumped up to 2%.

Product data becomes a performance driver

Clear, accurate and helpful product data and insights helped customers to make decisions more quickly this Peak period, that is according to Romain Fouache, CEO at Akeneo.

Romain says, ‘November once again showed that retailers who entered peak with complete, consistent product data were best placed to capitalise on demand.’

‘We saw strong campaigns from brands that invested early in enriching product content, ensuring shoppers had the detail needed to convert quickly despite intense promotional noise.’

‘Retailers accelerating campaign launches also relied on accurate, up to date data to adjust offers in real time.’

‘Those using structured product information to power personalised recommendations appeared to lift both AOV and loyalty.’

Romain notes, ‘The real winners were those that treated product data as a strategic asset, not a compliance exercise.’

Approaches to promotions and profitability

This wouldn’t be a Peak trading summary blog without reflecting on retailers’ strategies towards discounting and promotions.

Dan Bond, VP of Marketing at RevLifter has provided us with ample insights on the approaches that worked this Black Friday.

He says, ‘Black Friday 2025 gave us the clearest evidence yet that deeper discounts don’t automatically mean better results.’

‘Retailers increased the share of items at 15%+ off from 45% to 50%, yet most categories still declined.’

Many of ‘The brands that won focused on maximising each transaction rather than just chasing conversions.’

‘When traffic spikes are guaranteed, the smart play is increasing basket value – through bundles, thresholds, and cross-sells – not just slashing prices to get the sale.’

Dan shares, ‘Anyone can discount their way to a conversion. The real skill is turning that peak traffic into peak revenue.’

Similarly, Hemang Nathwani, CEO and Co-Founder, at Price Trakker reflects on how ‘This year’s Black Friday showed a clear shift away from single-day spikes toward longer, more controlled promotional periods.’

‘Many retailers launched earlier but relied on targeted discounts rather than blanket markdowns, which helped protect margin while still driving volume.’

‘From the data we observed, campaigns that maintained consistent pricing once launched performed better than those that repeatedly changed offers.’

Hemang shares, ‘Some retailers also stood out by clearly setting expectations around promotion length and stock availability, reducing customer frustration.’

‘Overall, the strongest performance came from retailers using real-time competitor data to guide decisions, rather than reacting late to market noise,’

Post-purchase trends

Customer behaviour

Gavin Murphy, CMO at delivery management and post-purchase experience provider Scurri reflects on customer behaviour over Peak.

Interestingly, Scurri found that ‘Across November we saw shoppers delay purchases until the final promotional push, with Cyber Monday orders surging to around 70% higher than Black Friday.’

‘Overall combined event volumes were up +15% YoY, with the strongest growth on the Saturday and Sunday (+19% each).’

Gavin saw that ‘Delivery preferences also shifted; standard delivery rose to 25% of orders (from 21% in 2024) as customers increasingly expect standard to arrive faster, while express fell sharply to 29% (from 36%).’

‘These trends signal a more selective, digitally driven peak, where agile fulfilment and strong post-purchase experiences are becoming critical to sustaining momentum into Christmas,’ shares Gavin.

Delivery timeframes over Peak

This year showed the importance of presenting accurate delivery timeframes to consumers.

By being specific about what day an order will arrive removes ambiguity at the post-purchase stage and can help to install confidence that can lead to increased conversion.

Garth Stapleton, Head of Sales Northern Europe at Parcel Perform reflects on delivery offerings over Black Friday.

He shares, ‘Black Friday 2025 confirmed the shift to ‘Black November,’ with sales spreading across the month as retailers started deals earlier.’

‘Parcel Perform data showed European carriers averaged 1.54-day delivery during peak, yet many retailers still promised 5+ days at checkout—playing it safe with their metrics but potentially losing sales.’

‘The real innovation wasn’t faster shipping, but honest promising. Retailers using real-time data to promise accurate dates (2-3 days) gained a conversion advantage over competitors padding estimates.’

Garth says, ‘For 2026, closing the gap between what carriers actually deliver and what retailers promise will matter more than shaving hours off transit.’

Cross border trends

While IMRG exclusively tracks UK online sales, some of our members track cross-border performance, helping to give a bigger picture of Peak 2025 performance.

Lee Thompson, CEO at fulfilmentcrowd reveals, ‘The peak weekend highlighted much of what we already knew about cross-border shoppers: they expect speed and convenience, and the retailers who plan ‘in-country’ fulfilment reap the rewards.’

‘Across our network, EU activity jumped +28% on Cyber Monday – with volumes at our Leipzig centre almost doubling (+98%) – and US orders rose +80% YoY on Black Friday.’

Lee exclaims, ‘The standout innovators from our perspective were those who moved stock closer to their customers ahead of peak, cutting delivery times and making returns much easier.’

‘This year’s data reinforces that operational agility and consumer convenience are both huge brand differentiators.’

Managing returns

As with all Peak trading periods, retailers are met with an influx of returns for unwanted items or gifts.

Wouter ten Heggeler, Product Manager at ReBound by Reconomy comments that ‘Returns fraud remains a significant challenge for retailers and brands, particularly during busy trading periods like Black Friday.’

‘While there are many theories about what drives this, from organised criminal activity to opportunistic ‘wardrobing’, we’re actively validating these assumptions through new fraud-checking capabilities.’

“Proprietary Machine Learning models can predict fraudulent returns. Early business cases suggest that retailers could save substantial amounts of revenue and time by reducing fraudulent refunds.’

‘AI-driven analytics and close collaboration between retailers and returns partners are key to addressing returns fraud.’

‘By detecting suspicious patterns early and streamlining quality control, retailers and brands can quickly separate genuine returns from fraudulent ones, helping protect margins during high-volume sales events like Black Friday.’

Want to read more? Here are some other IMRG blogs that may take your interest:

Post-Black Friday customer retention strategies – IMRG

Black Friday 2025: An early snapshot of a sharper, smarter peak – IMRG

Using competitor availability data to anticipate market gaps – IMRG

How can retail logistics be more sustainable in peak season? – IMRG

Peak 2025: Early Black Friday insights revealed – IMRG

Published 22/12/25